What is an Insurance Deductible and How Does It Work?

Introduction

An insurance deductible is one of the most important concepts in personal finance. You will find a deductible in nearly every type of insurance policy, from auto and home to health and disability. Yet, despite its prevalence, it remains a source of confusion for many consumers. People often choose a deductible without a clear understanding of what it is, how it works, or how that choice impacts their premiums. This lack of knowledge can lead to paying too much for premiums or facing unexpected out-of-pocket costs in a time of crisis. This guide will demystify the insurance deductible. We will explain what it is, how it affects your financial life, and provide a clear framework for choosing the right deductible to fit your personal financial situation and risk tolerance.

What is an Insurance Deductible? A Foundational Concept

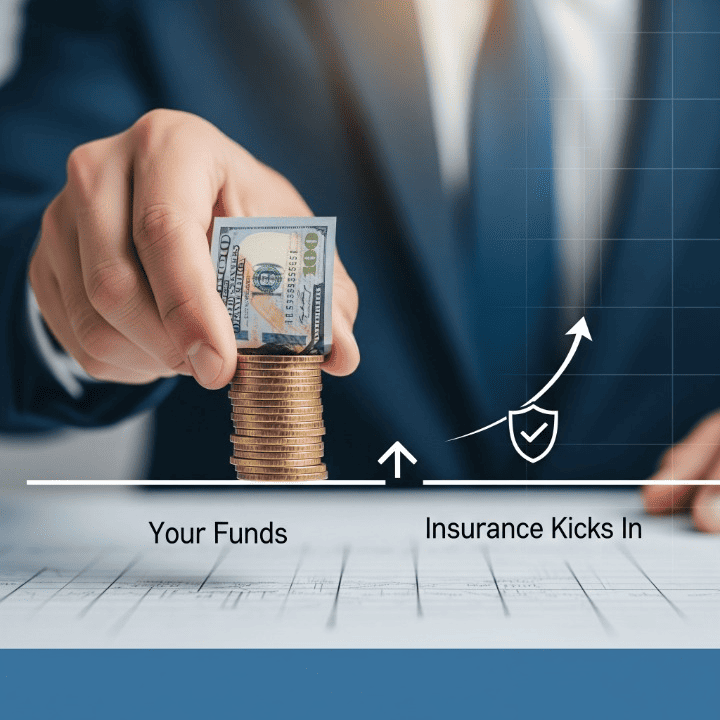

At its core, an insurance deductible is the amount of money you agree to pay out of your own pocket before your insurance company starts paying for a claim. Think of it as your share of the cost of a covered event. Once you meet your deductible, the insurance company will begin to pay for the rest of the covered costs, up to the policy’s limit.

Here is a simple example. Imagine you have a car accident that causes $5,000 in damage, and your auto insurance policy has a $1,000 deductible. You are responsible for paying the first $1,000 of the repair costs. Your insurance company would then pay the remaining $4,000. This shared responsibility between you and the insurance company is the fundamental principle of a deductible. It ensures that you have some financial stake in the outcome of a claim, which helps to keep premiums low for everyone.

The Inverse Relationship: Deductible vs. Premium

There is a direct and inverse relationship between your deductible and your premium. A premium is the regular payment you make to the insurance company for your coverage. The rule is simple: a higher deductible means a lower premium, and a lower deductible means a higher premium.

The logic behind this relationship is straightforward. If you choose a higher deductible, you are agreeing to take on more of the financial risk yourself. You are telling the insurance company that you are willing and able to pay a larger amount out-of-pocket in the event of a claim. In return for you taking on this higher risk, the insurance company charges you a lower premium. Conversely, if you choose a very low deductible, the insurance company is taking on more of the risk, and it will charge you a higher premium to compensate. This trade-off between a lower monthly cost and a higher out-of-pocket risk is the central decision you must make when choosing a policy.

Deductibles in Different Types of Insurance

Deductibles work differently depending on the type of insurance policy. Understanding these nuances is crucial for managing your financial risk.

Health Insurance

Health insurance deductibles are typically annual. This means you must pay the full deductible amount for covered medical services within a single calendar year before your insurance company begins to pay. Once you meet the deductible, your copayments and coinsurance for doctor visits and other services will typically begin. A high-deductible health plan, for example, is a common option that comes with a very low premium but a high deductible. It is often a popular choice for young, healthy people who do not expect to need a lot of medical care.

Car Insurance

Car insurance deductibles are typically per-claim. This means you must pay the deductible each time you file a claim for a covered event. In addition, your car insurance policy may have different deductibles for different types of coverage. You might have a $500 deductible for collision coverage, which pays for damage to your car in an accident, and a $250 deductible for comprehensive coverage, which pays for damage from things like theft, vandalism, or a tree falling on your car.

Homeowners Insurance

Homeowners insurance deductibles are also typically per-claim. They can be a fixed dollar amount or a percentage of your home’s insured value. A percentage-based deductible is common for weather-related claims, such as damage from a hurricane or a windstorm. For example, if your home is insured for $300,000 and your policy has a 1% hurricane deductible, you would be responsible for paying the first $3,000 of the cost of a hurricane claim.

Choosing the Right Deductible for Your Situation

Choosing the right insurance deductible is a personal financial decision. It requires you to balance the cost of your premiums with your ability to pay out-of-pocket in a crisis. Here is a decision framework to help you choose.

- Assess Your Emergency Fund: The size of your emergency fund should be a primary factor. Your emergency fund should be large enough to comfortably cover your highest deductible. If your car insurance deductible is $1,000 and your homeowners insurance deductible is $2,000, you should have at least $2,000 in your emergency fund.

- Consider Your Financial Situation: Can you comfortably afford a higher out-of-pocket cost in a crisis? If so, you may want to choose a higher deductible to lower your monthly premiums. The money you save on premiums can then be used for other financial goals.

- Evaluate Your Risk Tolerance: Are you a person who is comfortable with taking on a bit of risk to save money? Or do you prefer to pay a higher premium to have the peace of mind that your out-of-pocket costs in a crisis will be minimal? Your personal risk tolerance should be a key factor in your decision.

Practical Tips for Managing Your Deductible

Once you have chosen your deductible, you can use a few simple strategies to manage it effectively.

- Maintain an Emergency Fund: We cannot overstate this. Your emergency fund is the key to successfully managing a high deductible. It ensures that you can handle the out-of-pocket costs of a claim without financial stress.

- Review Your Policy Annually: Review your insurance policies and your deductibles at least once a year. Your financial situation and your personal risk tolerance can change over time. Your policy should reflect your current reality.

- Choose an Appropriate Deductible for Each Policy: The right deductible for your car insurance may not be the right deductible for your health insurance. You can and should have different deductibles for different types of policies based on their unique risks and costs.

Conclusion

An insurance deductible is a key component of every insurance policy. It is a tool for sharing risk with your insurance company. By understanding what a deductible is, how it works in different types of policies, and how it impacts your premiums, you can make a smart financial decision. A deductible is not an arbitrary number. It is a strategic choice that should be a part of your overall financial plan. By choosing a deductible that aligns with your emergency fund and your risk tolerance, you can save money on your premiums and have the peace of mind that you are prepared for a crisis.