What Happens to Your 401(k) When You Change Jobs?

Introduction

The excitement of starting a new job often comes with a host of new questions, and not all of them are about your new salary or health benefits. One of the most critical, yet often overlooked, questions is: “What happens to my old 401(k) when you change jobs?” For many, the answer is a source of confusion and procrastination. The temptation to simply leave your old retirement account behind or, worse, to cash it out, can be strong. However, the decision you make about your old 401(k) is a crucial one that can have a monumental impact on your long-term retirement planning. This guide will demystify the process, breaking down the four primary options for your old 401(k) and providing a clear framework to help you make an informed choice that safeguards your financial future.

The Four Options for Your Old 401(k)

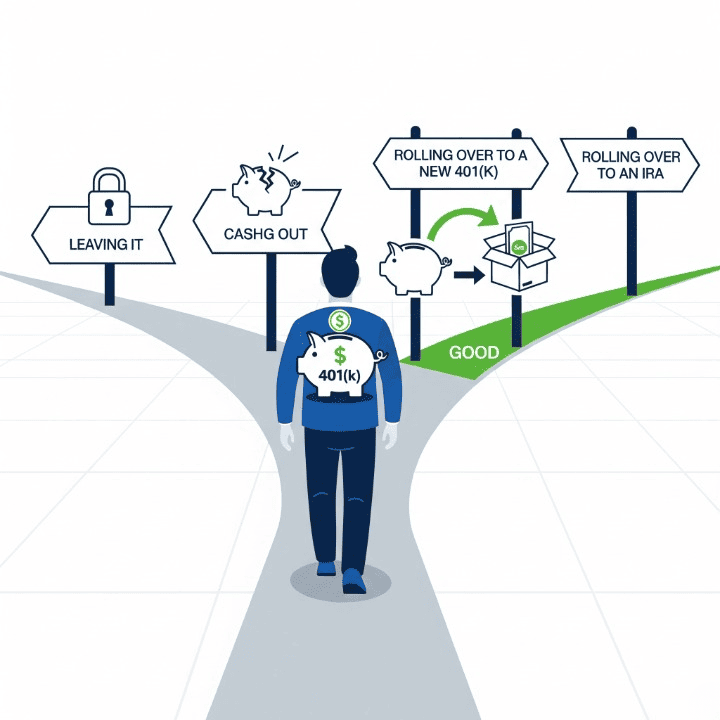

When you leave a job, you have four main options for handling the money you have saved in your old 401(k) plan.

- Leave the money in your old employer’s plan: This is a passive approach that requires no immediate action.

- Cash out your 401(k): You can take the money as a lump sum payment. This is almost always a bad idea.

- Roll it over to your new employer’s 401(k): You can transfer the money to your new workplace’s retirement plan.

- Roll it over to an Individual Retirement Account (IRA): You can move the money into an IRA that you own and control.

Each of these options has its own set of pros and cons, and the best choice for you will depend on your personal financial situation and goals.

Option 1: Leaving Your Money in the Old 401(k)

The path of least resistance is often to do nothing. If your balance is above a certain minimum (often $5,000), you can simply leave your money in your former employer’s 401(k) plan.

Pros

The main advantage of this option is its simplicity. You don’t have to make any new decisions or fill out any new paperwork. Your money continues to be invested in the plan’s portfolio, and you can access the funds according to the plan’s rules. For someone who is happy with the investment options and low fees in their old plan, this can be a reasonable, albeit passive, choice.

Cons

However, leaving your money behind has significant drawbacks. You can no longer make new contributions to the account, which means its growth is limited to investment returns. You may also find it difficult to track your old account, especially as you move on to new jobs. Having multiple small retirement accounts at different institutions can make it hard to get a clear, consolidated view of your financial picture. This can lead to your old 401(k) being forgotten, which is a major mistake in long-term retirement planning.

Option 2: Cashing Out Your 401(k)

This is the one option that financial experts almost universally advise against. Cashing out your 401(k) means taking the money as a lump sum payment.

The Cost of Cashing Out

The financial penalties for cashing out are severe. First, the entire amount of your withdrawal will be considered taxable income for the year. This can push you into a higher tax bracket, and a significant portion of your money will go to the government. Second, if you are under the age of 59½, you will also be hit with an additional 10% early withdrawal penalty.

Let’s look at an example. If you have a $20,000 401(k) when you change jobs and cash it out, you could lose up to a third of that money immediately. Your employer may be required to withhold 20% for federal income tax, and you would still owe the additional income tax and the 10% penalty. This means you could end up with as little as $14,000, and you will have permanently robbed your future self of decades of tax-deferred compounding.

Cashing out your 401(k) is a last resort and should be avoided at all costs.

Option 3: Rolling It Over to Your New Employer’s 401(k)

A great option for many people is to roll their old 401(k) into their new employer’s retirement plan. This is a tax-free transfer of funds from one plan to another.

Pros

The primary benefit of this option is consolidation. It brings all your retirement savings into one place, making it much easier to track and manage. This simplifies your retirement planning and gives you a clear picture of your total nest egg. It also allows you to make consistent contributions to a single account, which is a key to long-term success.

Cons

The main drawback is that you are limited to the investment options available in your new employer’s plan. Some plans may have high fees or a limited menu of funds. In some cases, you may have to wait for a certain period of time before you are eligible to roll over your funds. For these reasons, you should review your new employer’s plan carefully before you make a decision.

Option 4: Rolling It Over to an Individual Retirement Account (IRA)

This is often the most recommended and most flexible option for handling your old 401(k). A direct rollover to an IRA is a tax-free transfer of funds from your employer-sponsored plan into an individual account that you own and control.

Pros

The biggest advantage of an IRA rollover is the freedom it provides. You can open an IRA at any financial institution you choose, and you have access to a virtually unlimited number of investment options, from low-cost index funds and ETFs to individual stocks and bonds. This gives you far more control and flexibility than you would have in any employer-sponsored plan. It also allows you to consolidate your retirement savings into a single account, making it easy to manage your entire financial picture.

Cons

The main drawback is that you are responsible for managing the account yourself. This means you must do the research and choose the investments. However, for a savvy investor who wants more control over their financial destiny, this is a very small price to pay.

A rollover can be a tax-free event. If you roll your funds from a traditional 401(k) into a traditional IRA, there are no taxes or penalties. You can also roll your funds into a Roth IRA, but you will have to pay income tax on the amount you roll over.

Making the Right Choice: A Decision Framework

When a new job presents the question of what to do with your old 401(k), a simple decision framework can help.

- Is cashing out an option? No, it is not. The penalties are too severe.

- How good is your new employer’s plan? If it has a great menu of low-cost funds, a good platform, and you want to keep everything in one place, a rollover to the new 401(k) is a great option.

- Do you want more control and more investment options? If the answer is yes, then a rollover to an IRA is likely the best choice for you.

Conclusion

The decision of what to do with your 401(k) when you change jobs is a critical one. While the path of least resistance is to do nothing, and the temptation to cash out is a serious threat, the most financially sound choice is to make a proactive, informed decision. A rollover to a new employer’s plan or, more commonly, to an IRA, is a tax-free way to consolidate your savings and give you more control over your financial future. The choice you make can have a monumental impact on your long-term wealth, so take the time to understand your options. Your future self will be grateful for the discipline you show today.