What Are NFTs? A Simple Guide to Non-Fungible Tokens

Introduction

In the last few years, a new three-letter acronym has captivated headlines, dominated social media, and become a significant part of the cryptocurrency conversation: NFT. Short for non-fungible token, NFTs have been sold for millions of dollars, purchased by celebrities, and have sparked an intense debate about the future of digital art and ownership. For many people, however, NFTs remain a source of confusion. What exactly are they? Why are people paying so much for them? This guide will demystify non-fungible tokens, providing a clear and simple explanation of their core concepts. We will explore how they work, their potential applications beyond just digital art, and the risks and rewards of this rapidly evolving market. By the end, you will have a foundational understanding of what NFTs are and why they have become such a powerful force in the digital world.

The Core Concept: Fungible vs. Non-Fungible

To understand what a non-fungible token is, you must first understand the difference between fungible and non-fungible assets.

- Fungible Assets: These are assets that are interchangeable with one another. A dollar bill is a perfect example. One dollar bill is identical in value and nature to another dollar bill. You can trade one for another, and no one cares which specific dollar you have. Similarly, one Bitcoin is fungible with any other Bitcoin.

- Non-Fungible Assets: These are assets that are unique and cannot be interchanged. A plane ticket, for example, is non-fungible. Your ticket for a specific seat on a specific flight cannot be swapped for another ticket without a change in value. Similarly, a unique piece of artwork is non-fungible. Its value is tied to its uniqueness and its provenance.

An NFT is, therefore, a digital asset that is unique and cannot be interchanged. It is a one-of-a-kind digital item. It is this uniqueness that gives NFTs their value and separates them from cryptocurrencies like Bitcoin.

How Do NFTs Work?

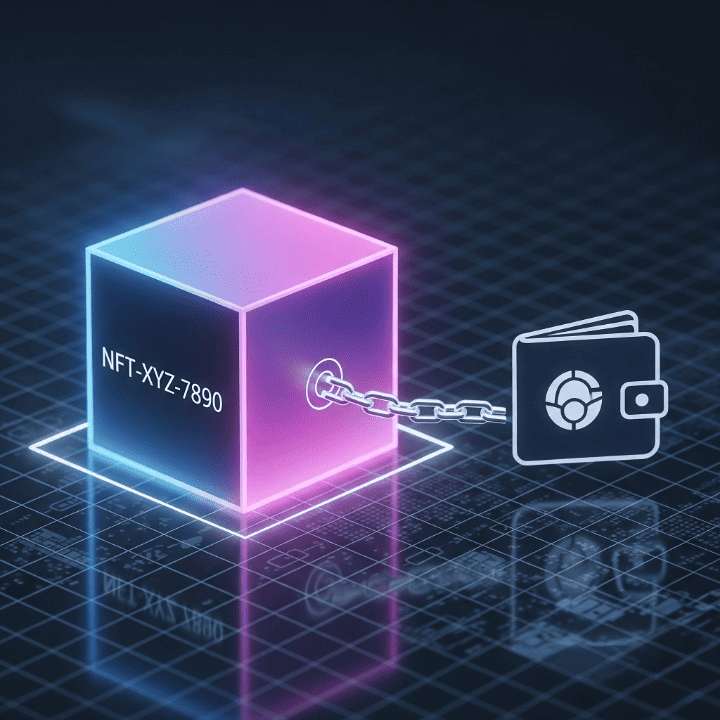

An NFT is a digital token that exists on a blockchain, which is a decentralized public ledger. The vast majority of NFTs are built on the Ethereum blockchain, but other blockchains also support them. The token contains data that proves its authenticity and its ownership. This data is what makes the NFT unique and verifiable.

It’s crucial to understand that the NFT itself is not the digital asset it represents. The NFT is the certificate of ownership. It is the proof that you own a specific, unique digital item. The digital asset itself—whether it’s a JPEG, a video file, or a piece of music—can be copied and shared endlessly on the internet. However, only one person can own the unique NFT that points to that file. This ability to have provable digital ownership is a fundamental shift in the digital world.

Beyond Digital Art: The Real-World Potential

While the initial hype around NFTs has been focused on digital art and collectibles, the underlying technology has much broader applications. The ability to create a unique, verifiable digital token has immense potential for a variety of industries.

- Gaming: In the world of online gaming, players can spend hundreds or thousands of dollars on in-game items, such as unique skins or weapons. These items are controlled by the game’s developer. An NFT changes this. A player could own an in-game item as an NFT, giving them true ownership. They could sell it, trade it, or even use it in other games. This creates a new, decentralized in-game economy.

- Event Ticketing: Event tickets are often subject to fraud and scalping. An NFT could be used as a unique, verifiable ticket. Once a ticket is scanned at an event, the NFT is “burned,” or retired, which prevents it from being used again. This can help prevent fraud and eliminate the black market for tickets.

- Digital Identity: Your digital identity is currently scattered across dozens of platforms, from social media to email. An NFT could be used to create a single, self-sovereign digital identity that you own and control. This could also be used for medical records, certifications, or even diplomas.

- Real Estate: The technology could be used to represent fractional ownership of physical assets, such as a piece of real estate. This could make it easier to buy and sell ownership stakes in expensive assets.

These applications show that an NFT is more than just a JPEG. It is a powerful technology that could change the way we own and interact with digital and physical assets.

The Risks and Rewards of NFTs

The NFT market is a dynamic and speculative place. For a potential investor, it’s essential to understand both the rewards and the significant risks involved.

The Rewards

For artists and creators, NFTs have created a new way to monetize their work directly, without the need for a gallery or a music label. The smart contract behind an NFT can also be programmed to give the original creator a percentage of all future sales of their work, creating a passive royalty stream. For collectors, NFTs offer a new way to engage with a community and to support creators.

The Risks

The risks, however, are immense.

- High Volatility: The NFT market is incredibly volatile and speculative. The value of an NFT can drop to zero overnight. Most NFTs will not be profitable investments. The market is driven by hype and trends, which can change in an instant.

- Scams and Fraud: The unregulated nature of the market has made it a breeding ground for scams. These include “rug pulls,” where a project’s creators abandon it after selling off their NFTs, and “phishing” scams, where hackers trick people into giving up their crypto wallet’s private keys.

- Security: While the blockchain is secure, the platforms and wallets used to store and trade NFTs are not. A vulnerability in a marketplace or a mistake in storing your wallet’s private keys can lead to the permanent loss of your NFTs.

- Copyright and IP Issues: In many cases, buying an NFT does not give you the copyright or intellectual property rights to the digital asset. You are simply buying the certificate of ownership. The legal landscape around this is still in its early stages.

A Step-by-Step Guide to Buying and Storing Your First NFT

If you are interested in getting involved in the NFT market, here is a simple guide to get you started.

- Get a Crypto Wallet: You need a digital wallet to store your cryptocurrency and your NFTs. The most popular wallet for the Ethereum network is MetaMask.

- Buy Cryptocurrency: You will need to buy a cryptocurrency that is used on the blockchain of your chosen NFT. For most NFTs, this is Ether (ETH).

- Choose a Marketplace: There are several online marketplaces where you can buy and sell NFTs. OpenSea is the largest and most popular.

- Understand the Costs: The price of an NFT is not the only cost. You must also pay a “gas fee,” which is the transaction fee for using the blockchain. These fees can fluctuate depending on the network’s activity.

Conclusion

NFTs are a powerful and transformative technology. At their core, they are a digital certificate of ownership that provides a new way to interact with and create value in the digital world. While the market has been driven by hype and speculation, the underlying technology has the potential to reshape everything from gaming to digital identity. For anyone considering getting involved, it is essential to understand the core concepts of fungible vs. non-fungible assets and to be aware of the immense risks. The real value of NFTs lies not in the price of a single piece of digital art, but in the new, decentralized future that they are helping to build.