Understanding Your Homeowners Insurance Policy: What’s Covered?

Introduction

For most people, a home is their single largest financial asset. It represents a lifetime of savings and a sense of security. Because of this, a homeowners insurance policy is not just a recommendation. It is a non-negotiable requirement. Many lenders mandate it. A significant number of homeowners, however, do not truly understand what their policy covers. They only find out when they need to file a claim. This lack of knowledge can cause financial stress during a crisis. This guide demystifies your homeowners insurance policy. We break down its key components. We help you understand the protection you have. By knowing what is covered and, just as importantly, what is not, you can ensure your largest asset is properly protected.

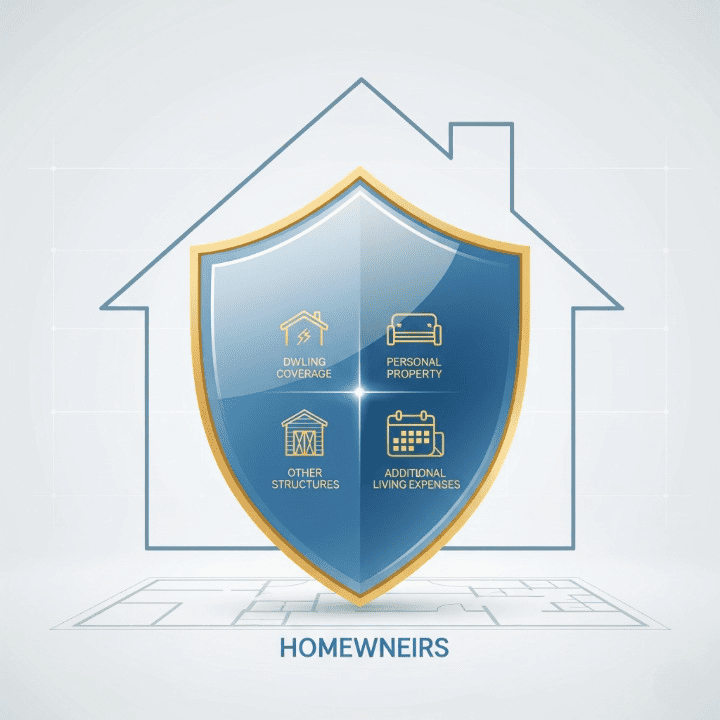

The Four Pillars of a Homeowners Insurance Policy

A standard homeowners insurance policy has four primary types of coverage. Each one serves a distinct purpose. It protects a different aspect of your property and your financial liability.

1. Dwelling Coverage

This is the most critical part of your policy. Dwelling coverage protects the physical structure of your home. This includes the roof, walls, foundation, and floors. It also covers any attached structures, like a garage or a deck. The coverage amount is based on the cost to rebuild your home from the ground up, not its market value. You must have enough dwelling coverage to replace your home entirely after a total loss. This includes a fire. The dwelling coverage often includes the costs for rebuilding and debris removal.

2. Personal Property Coverage

This coverage protects your belongings inside the home. It includes everything from your furniture and clothes to your electronics and appliances. The coverage amount is typically a percentage of your dwelling coverage, often 50% to 70%. It’s important to create a home inventory. This ensures you have enough coverage to replace all your personal items. A key feature of personal property coverage is its extended protection. It often protects your belongings even when they are not on your property. For example, your homeowners insurance would likely cover your laptop if it were stolen from your car while on vacation.

3. Other Structures Coverage

A standard homeowners insurance policy also covers other structures on your property. These are structures not attached to the main house. Examples include a detached garage, a shed, or a fence. The coverage amount is typically a percentage of your dwelling coverage. It is often around 10%. This ensures that all the structures on your property are protected from a covered peril.

4. Loss of Use (Additional Living Expenses)

This is a key part of a homeowners insurance policy. It covers the cost of additional living expenses if your home becomes uninhabitable. This happens due to a covered event. For example, a fire might force you to move out of your home for a month. Your “Loss of Use” coverage would then pay for your hotel bills, meals, and other living expenses. This prevents a crisis from becoming a total financial disaster. Without this coverage, you would pay for a hotel and food out of your own pocket. This could drain your emergency fund.

Understanding Perils: What Is and Isn’t Covered

A homeowners insurance policy does not cover every possible event. It covers a specific list of events called “perils.” Understanding which perils are covered and which are excluded is essential.

What Is Typically Covered?

A standard policy typically covers a wide range of common perils. This includes:

- Fire and smoke damage

- Lightning strikes

- Windstorms and hail

- Theft and vandalism

- Falling objects

- Water damage from a burst pipe or appliance

What Is Typically Excluded?

This is the most important part to understand. Standard homeowners policies do not cover certain events. The two most common and most important exclusions are:

- Floods: A standard policy does not cover flood damage from a natural disaster. An example is a river overflowing its banks. This requires a separate flood insurance policy.

- Earthquakes: An earthquake is also not covered. It requires a separate policy or an endorsement.

These exclusions highlight the importance of reviewing your policy. You should consider additional coverage if you live in an area at risk for these types of natural disasters.

The Financial Language of Your Policy

To effectively manage your homeowners insurance, you must understand a few key terms.

- Deductible: This is the amount of money you pay out of your own pocket before your insurance coverage begins. A higher deductible will lower your monthly premium. However, it also means you will have to pay more in an emergency.

- Premiums: This is the regular payment you make to the insurance company for your coverage. Premiums are determined by many factors. These include the location of your home, its age, and the amount of coverage you have.

- Actual Cash Value (ACV) vs. Replacement Cost Value (RCV): This is a critical distinction. An ACV policy pays you the depreciated value of your belongings. A five-year-old television is worth far less than its original purchase price. In contrast, an RCV policy pays you the cost to replace your belongings with new ones. While an ACV policy has a lower premium, an RCV policy provides much better protection. Financial experts typically recommend an RCV policy for homeowners.

Tailoring Your Policy: Endorsements and Riders

A standard homeowners insurance policy may not be enough. You can customize your coverage. You do this by adding endorsements or riders. These are add-ons that provide extra protection for specific risks. For example, you may need a separate endorsement if you have expensive jewelry or art. This is to cover those items. Similarly, if you live in a flood or earthquake-prone area, you can purchase a separate policy. This allows you to tailor your policy to your unique needs.

Conclusion

A homeowners insurance policy is a vital tool for protecting your largest financial asset. You can ensure your home and belongings are protected by understanding the four pillars of coverage—dwelling, personal property, other structures, and loss of use. Just as importantly, you must understand what your policy excludes, such as floods and earthquakes. This prevents a false sense of security. A policy is not just a requirement for your mortgage. It is a crucial tool for financial risk management and a source of peace of mind. Taking the time to read and understand your policy is a simple step. It can protect your home and your financial future for years to come.