Roth IRA vs. Traditional IRA: Which Retirement Account is Best for You?

Introduction

Choosing the right retirement savings account is one of the most important financial decisions you will ever make. While most people understand they need to save for the future, the alphabet soup of account types can be incredibly confusing. At the heart of this confusion are two of the most popular individual retirement accounts (IRAs): the Roth IRA and the Traditional IRA. At a glance, they may seem identical, as they both have the same annual contribution limits. However, they operate on a fundamentally different principle: taxes. The choice between them is a crucial bet on your future financial life. This guide will demystify the two accounts, providing a detailed comparison of their tax implications, withdrawal rules, and who each is best for. By the end, you will have a clear framework to help you decide which account is the right choice for your unique financial situation and long-term retirement planning goals.

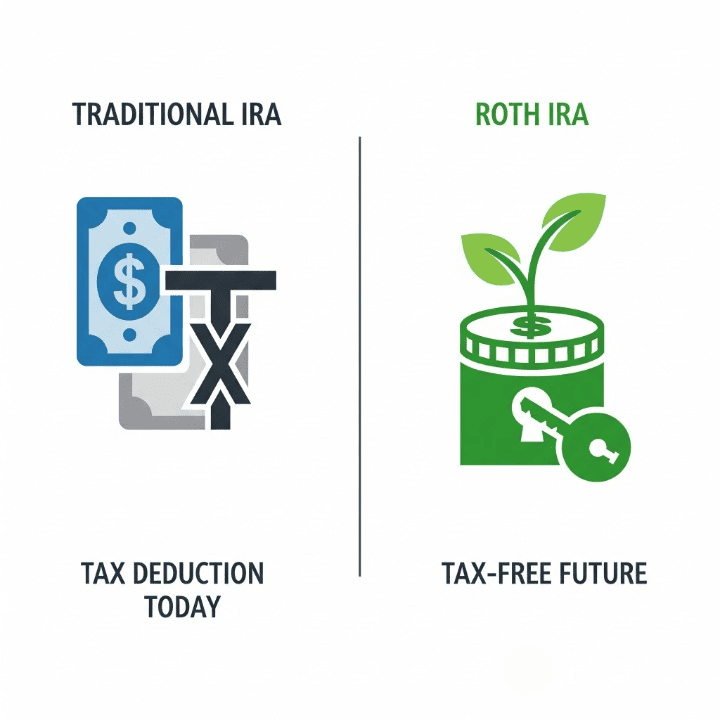

Understanding the Traditional IRA: A Tax Deduction Today

The Traditional IRA is a retirement account that operates on a “pay taxes later” model. When you contribute to a Traditional IRA, you are doing so with pre-tax dollars. This means that your contributions are tax-deductible in the year you make them, which has the immediate benefit of lowering your current taxable income. The money you contribute, as well as any earnings it generates, grows tax-deferred. You will not pay any taxes on the growth while the money is in the account. The full amount—both your contributions and your investment gains—is only taxed when you begin making withdrawals in retirement.

This structure is particularly appealing for individuals who are currently in a high tax bracket. By making a Traditional IRA contribution, they can reduce their current tax bill. The expectation is that they will be in a lower tax bracket in retirement, making the tax payment later on less expensive. For this reason, the Traditional IRA is often a powerful tool for those who are mid-career and want to lower their taxable income now.

Understanding the Roth IRA: Tax-Free Growth and Withdrawals

The Roth IRA operates on the opposite principle of the Traditional IRA. It is a “pay taxes now” account. Contributions to a Roth IRA are made with after-tax money, meaning your contributions are not tax-deductible. You receive no immediate tax break. The major advantage, however, comes in the future. All of your investment gains and all of your withdrawals in retirement are completely tax-free.

For a young person just starting their career, a Roth IRA can be a highly attractive option. You are likely in a lower tax bracket today than you will be in your peak earning years or in retirement. By paying the small amount of tax now, you are securing a lifetime of tax-free growth and tax-free income in retirement. This can be a significant financial advantage, as it protects your retirement savings from future tax increases. You also don’t have to worry about managing your tax bill in retirement, which can simplify your financial life.

A Side-by-Side Comparison: Key Differences

The choice between a Roth IRA vs. Traditional IRA ultimately depends on your financial situation and your outlook on future tax rates. The core differences are a matter of tax treatment, contribution rules, and withdrawal flexibility.

The Required Minimum Distribution (RMD) rule is a key difference. With a Traditional IRA, the government requires you to start taking distributions at age 72, which you must pay taxes on. With a Roth IRA, there are no RMDs during your lifetime, allowing your money to continue to grow tax-free for as long as you live. This flexibility is a significant benefit.

The Big Question: Pay Taxes Now or Later?

The decision between a Roth IRA vs. Traditional IRA is a personal bet on future tax rates.

- Choose a Traditional IRA if…

- You are in a high tax bracket today and want to reduce your current tax bill.

- You believe you will be in a lower tax bracket in retirement.

- You have a higher income and are not eligible to contribute to a Roth IRA.

- Choose a Roth IRA if…

- You are in a lower tax bracket today.

- You believe your tax bracket will be higher in retirement.

- You want to have a source of tax-free income in retirement.

- You want to avoid Required Minimum Distributions.

For many young people, the Roth IRA is a great choice because they are likely in a low tax bracket and expect to earn more in the future. For those in their peak earning years, the immediate tax deduction from a Traditional IRA can be very appealing.

Beyond the Choice: A Strategic Approach

For a truly diversified retirement planning strategy, many financial experts recommend using both a Traditional and a Roth IRA if possible. This tax diversification gives you flexibility in retirement. In years where you need more money, you can pull from your Roth IRA to avoid increasing your taxable income. In years where you are in a lower tax bracket, you can pull from your Traditional IRA. This allows you to manage your tax burden in retirement and gives you greater control over your finances.

For high earners who are phased out of contributing to a Roth IRA, there is a strategy known as the “Backdoor Roth IRA” that allows them to contribute to a Roth account regardless of their income. This is a more complex strategy, but it shows that a Roth account is so valuable that even high earners are finding ways to get their money into it.

Conclusion

The choice between a Roth IRA vs. Traditional IRA is a critical one in retirement planning, but it should not be a source of stress. The decision comes down to a simple question of when you want to pay your taxes. The best choice is a personal one that aligns with your current income, your future expectations, and your tax strategy. The most important step, regardless of which account you choose, is simply to start. By understanding these powerful tools and making consistent contributions, you are taking control of your financial future and building the foundation for a secure and comfortable retirement.