Effective Strategies to Manage and Pay Off Student Loan Debt

Introduction

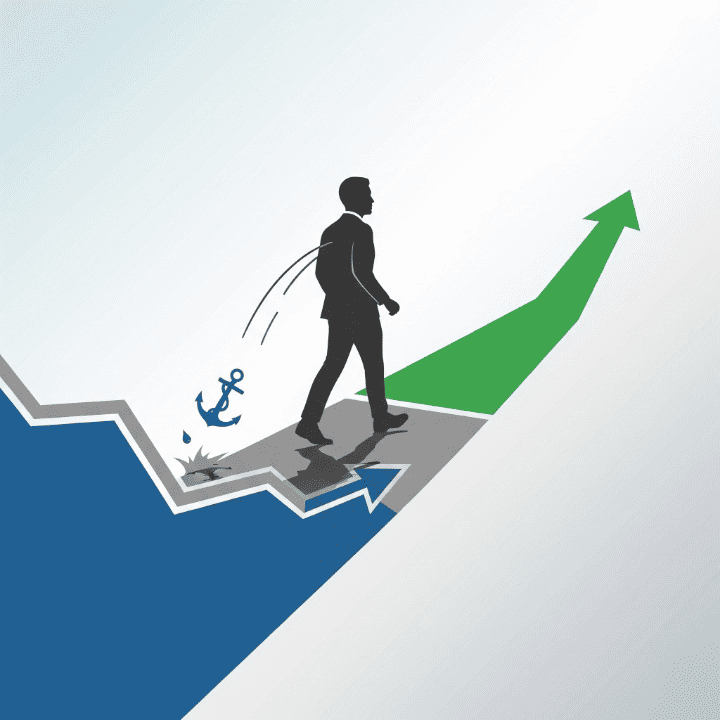

For millions of people, student loan debt is a major financial burden. It can feel like a heavy anchor, preventing you from saving for a home, investing for retirement, or simply living a life free from financial stress. The weight of this debt can be a constant source of anxiety, especially in a world of rising inflation and economic uncertainty. However, you are not powerless against your student loans. Moving from a passive mindset to a proactive, strategic one is the first step toward regaining control. This guide will provide a clear, comprehensive roadmap with effective strategies for managing your payments, potentially lowering your interest rates, and accelerating the repayment process. By applying these disciplined approaches, you can transform your relationship with your student loans and work toward a future of financial freedom.

The First Step: Understand Your Loans

Before you can build a plan to manage and pay off your student loan debt, you must first have a clear understanding of exactly what you owe. This is a crucial foundational step. Many people have multiple loans from different servicers, each with a different interest rate. The first step is to create a detailed list or a simple spreadsheet that includes all of your loans. For each loan, you should record the following information:

- The name of the loan servicer

- The current balance of the loan

- The interest rate

- The minimum monthly payment

- The type of loan (federal or private)

Once you have a clear, consolidated view of all your loans, you can begin to make strategic decisions. Without this information, any repayment strategy you choose will be a shot in the dark.

The Two Main Repayment Strategies

Once you have organized your loans, you can choose a repayment strategy that works for you. There are two popular and highly effective methods.

The Debt Snowball

This strategy focuses on paying off the loan with the smallest balance first. You make the minimum payment on all your other loans and put any extra money toward the smallest loan. Once that loan is paid off, you take the money you were paying on it and apply it to the next smallest loan. This creates a snowball effect, with the payments growing larger and larger as you go. The benefit of this method is psychological. It provides a quick win and a sense of momentum. This can be very motivating, helping you stay committed to your plan.

The Debt Avalanche

This strategy focuses on saving the most money over the long term. You make the minimum payment on all your loans and put any extra money toward the loan with the highest interest rate. Once that loan is paid off, you move on to the next loan with the highest interest rate. This method saves you the most money in interest over the life of your debt. For an individual who is motivated by numbers and wants to be as efficient as possible, this is the superior strategy from a purely mathematical standpoint. The best strategy is the one you can stick to.

Lowering Your Interest Rate

Your interest rate is a critical factor in how quickly you can pay off your student loan debt. A lower interest rate means more of your payment goes toward the principal, and you save a significant amount of money over the life of your loan. There are two primary ways you can potentially lower your interest rate.

Income-Driven Repayment Plans

If you have federal student loans and your income is low relative to your debt, an income-driven repayment (IDR) plan can be a powerful tool. These plans cap your monthly payment at a percentage of your discretionary income, often as low as 10%. They also have a forgiveness component, where any remaining balance is forgiven after a certain number of years. This can be a great way to make your payments more manageable, but it is important to understand that your total interest paid may be higher and the forgiven amount may be taxable.

Refinancing

Refinancing is the process of taking out a new loan to pay off your old student loans. This is typically done through a private lender. Refinancing can be a great option for someone with good credit who wants to get a new, lower interest rate and a single, consolidated payment. However, it is a decision you must make carefully. When you refinance a federal student loan into a private one, you lose all the protections that federal loans offer, such as forbearance, deferment, and access to IDR plans. This is a serious trade-off that you must consider.

Accelerating Your Payments

Once you have a plan in place, you can use a few simple tricks to accelerate your repayment and pay off your student loan debt faster.

Round-Up Your Payments

A simple way to pay off your loan faster is to make a slightly larger payment each month. For example, if your minimum payment is $157, you can round it up to $200. This extra $43 may not feel like much, but over the course of a year, it adds up to a significant extra payment. This simple habit can shorten the life of your loan by years.

Make Bi-Weekly Payments

This is another simple way to pay off your debt faster. Instead of making one full payment each month, you make half a payment every two weeks. This results in 26 half-payments per year, which is the equivalent of 13 full payments instead of 12. This extra payment per year can have a big impact on your total interest paid and the life of your loan.

Use Windfalls

Any extra money that comes your way, such as a tax refund, a work bonus, or a financial gift, can be used to make an extra payment on your student loans. This is a great way to make a large dent in your principal and accelerate your journey to being debt-free.

The Psychological Side of Student Loan Debt

Beyond the numbers, student loan debt has a significant psychological impact. The stress and anxiety it causes can be debilitating. However, creating a plan, no matter how small, can help you regain a sense of control. As you pay off loans and see your balances decrease, you will build a sense of momentum and accomplishment. Celebrate these small wins along the way. Your journey to being debt-free is a marathon, and staying motivated is just as important as being strategic.

Conclusion

Student loan debt can feel overwhelming, but with a disciplined and strategic approach, it is a problem you can solve. By taking the time to understand your loans, choosing an effective repayment strategy like the debt avalanche, exploring ways to lower your interest rate, and using simple tricks to accelerate your payments, you can take control of your financial life. The journey to being debt-free is a long one, but with a solid plan, it is a future you can achieve. The financial freedom you gain on the other side is worth every bit of effort.