Building a Financial Plan for Every Stage of Life

Introduction

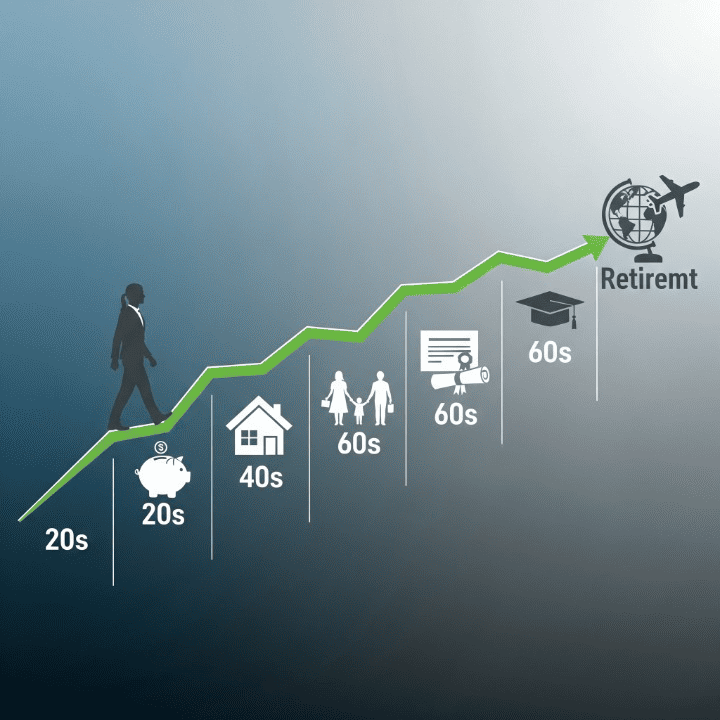

A financial plan is not a static document. It is a living, breathing roadmap that evolves as your life changes. What works for a single person in their 20s will not be sufficient for a couple in their 40s with a mortgage and children. A solid financial plan adapts to your changing circumstances, needs, and goals. It is a strategic tool that gives you a sense of control and purpose with your money. This guide will walk you through the key financial priorities and strategies for each major stage of life, from your first steps into the working world to your golden years of retirement. By understanding the unique challenges and opportunities of each phase, you can build a comprehensive and resilient financial plan that will help you achieve your goals and secure your financial future.

Stage 1: The Foundation (Your 20s and Early 30s)

This is the most critical period for setting a solid financial foundation. The decisions you make now, even small ones, will have a monumental impact due to the power of time and compound interest.

Build an Emergency Fund

The first and most non-negotiable step is to build an emergency fund. This is a dedicated pool of cash to cover unexpected expenses like a car repair or a sudden job loss. You should aim to save enough to cover at least three to six months of your essential living expenses. This fund is the foundation of your financial life. It prevents you from taking on high-interest debt or selling investments at a loss when a crisis occurs.

Pay Down High-Interest Debt

For many in this age group, student loans and credit card debt are a major obstacle. While some debt can be a useful tool, high-interest debt is a massive anchor. You should prioritize paying off this debt as aggressively as possible. Strategies like the debt avalanche method, which focuses on paying off the debt with the highest interest rate first, can save you a significant amount of money over time.

Start Saving for Retirement

This is the most powerful action you can take. Your greatest asset is time. Even a small, consistent contribution to a retirement account, such as an employer’s 401(k) or an Individual Retirement Account (IRA), can grow into a massive sum over decades. The key is to start now.

Stage 2: The Growth Years (Your 30s and 40s)

In this stage, your career is likely in full swing, and your income is growing. The focus shifts from setting the foundation to scaling it up and saving for major life goals.

Increase Retirement Contributions

As your income increases, you should make a commitment to increase your retirement savings. A good rule of thumb is to save a portion of every raise you receive. For example, if you get a 3% raise, you could increase your retirement contributions by 1% and enjoy the remaining 2% in your paycheck. This disciplined approach ensures that your savings grow along with your income.

Save for a Down Payment or Other Major Goals

This is the period when many people save for a down payment on a home, a child’s college education, or other significant financial goals. You should create a separate savings plan for each of these goals, using tools like a high-yield savings account to keep your money safe and accessible. These goals should be clearly defined and integrated into your overall financial plan.

Review Your Insurance Needs

As your family and financial responsibilities grow, your insurance needs will change. You should review your life and disability insurance policies. A life insurance policy, for example, ensures that your family will be financially protected if something were to happen to you. Your disability insurance protects your most important asset: your income. These are non-negotiable forms of protection.

Stage 3: The Peak Earning Years (Your 50s and 60s)

This is your last chance to make a final, aggressive push toward retirement. Your income is likely at its highest, and your financial focus should be on maximizing your retirement savings and preparing for the next phase.

Maximize Retirement Contributions

At this stage, you should be focused on maximizing all your tax-advantaged retirement accounts. The government allows individuals who are 50 and older to make catch-up contributions to their retirement plans. These special contributions allow you to put away an additional amount each year in your 401(k) and IRA. This is a powerful tool to make up for any lost time and to give your nest egg a significant boost in the final years.

Refine Your Investment Strategy

Your investment strategy should begin to shift from aggressive growth to capital preservation. As you get closer to retirement, a market downturn is a much greater risk, as you have less time to recover. You should consider shifting your portfolio to a more conservative mix of stocks and bonds. This ensures that your hard-earned savings are protected from significant market volatility.

Prepare for the Decumulation Phase

This is the time to start thinking about how you will spend your money in retirement. You should have a clear idea of what your expenses will be and what your income sources will be. You should also start to think about a withdrawal strategy for your portfolio.

Stage 4: Retirement and Beyond

You have reached your goal. The focus now shifts from saving to living off your savings.

Execute a Withdrawal Strategy

You should have a clear, sustainable withdrawal strategy in place. The 4% Rule is a common guideline that suggests you can safely withdraw 4% of your total portfolio’s value in the first year of retirement and adjust for inflation each year after. This strategy is designed to ensure that your money lasts for your entire lifetime.

Manage Your Portfolio for Income

Your portfolio’s purpose has now changed. Its goal is no longer just growth but to generate a sustainable income stream. You should consider a portfolio that is designed to provide income, using a mix of bonds and high-dividend stocks to supplement your social security or pension income.

Plan for Healthcare and Legacy

Healthcare costs are one of the biggest expenses in retirement. You should have a plan for how you will cover these costs. You should also begin to think about your legacy. Estate planning, such as a will or a trust, ensures that your assets are distributed according to your wishes.

Conclusion

A financial plan is a dynamic journey, not a destination. By understanding the unique challenges and opportunities of each stage of life, you can build a plan that is resilient, adaptable, and a true reflection of your goals. The decisions you make in your 20s and 30s lay the foundation. The actions you take in your 40s and 50s build on that foundation. The choices you make in retirement secure your future. By being proactive and disciplined at every stage, you can achieve financial security, freedom, and peace of mind for yourself and your loved ones.