From Claim to Prevention: How IoT and Proactive Tech Are Revolutionizing the Insurance Experience

Introduction

For decades, the insurance industry operated on a fundamentally reactive model. Policyholders filed claims after an incident occurred. This approach, while functional, often left individuals vulnerable. It also created significant costs for insurers. However, a profound shift is now underway. The integration of the Internet of Things (IoT) and other proactive technologies is revolutionizing this landscape. This transformation moves the focus from reacting to damage to actively preventing it. This article explores how connected devices and data analytics are redefining the insurance experience. It offers a glimpse into a future of personalized protection and enhanced security for everyone involved. Understanding these changes is crucial for navigating the evolving financial world.

The Traditional Insurance Paradigm: A Reactive Stance

Historically, insurance has been a safety net. It provided financial compensation after an unforeseen event. Policyholders paid premiums. In return, they received coverage for specific risks. When an incident happened, like a car accident or a house fire, a claim was filed. Insurers then assessed the damage. They subsequently processed the payout. This model worked. However, it placed the burden of loss squarely on the policyholder first. It also limited the insurer’s role to post-event recovery. There was little opportunity for intervention. Preventing damage before it occurred was not a core function. This reactive stance often led to higher costs. It also resulted in slower recovery times. Both parties faced limitations within this framework.

The traditional system relied heavily on historical data. Actuaries calculated risks based on past occurrences. They used aggregated statistics to determine premiums. This meant policies were often generic. They did not fully reflect individual risk profiles. For instance, a safe driver might pay the same as a riskier one. A homeowner with advanced security paid similarly to one without. The lack of real-time insights was a significant challenge. It made personalized risk assessment difficult. This old paradigm, while foundational, faced inherent inefficiencies. It was ripe for technological disruption. The desire for more tailored and preventative solutions grew.

Embracing Proactive Measures: The IoT Revolution

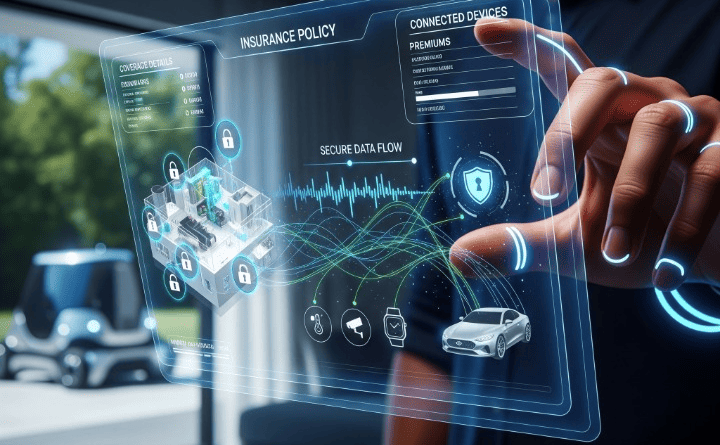

The Internet of Things (IoT) represents a network of interconnected devices. These devices include sensors, software, and other technologies. They are designed to connect and exchange data. This occurs with other devices and systems over the internet. In insurance, IoT shifts the paradigm dramatically. It moves from passive protection to active prevention. Instead of simply paying for damages, insurers can help prevent them. This is achieved by monitoring environments and behaviors in real-time. This proactive approach benefits both policyholders and insurance providers. It creates a safer, more efficient system. The era of reactive claim processing is steadily fading.

IoT devices gather vast amounts of data. This data is highly relevant to insurance risk. For example, smart home sensors detect water leaks. Connected cars monitor driving habits. Wearable devices track health metrics. This continuous stream of information provides unprecedented insights. Insurers can now assess risks with greater precision. They can also offer timely interventions. This helps mitigate potential losses. The focus moves to predicting and preventing incidents. This fundamental change is redefining the core value proposition of insurance. It offers a future where protection is always active.

Smart Homes: Preventing Property Damage

Smart home technology is a prime example of IoT in action. Devices like smart smoke detectors offer immediate alerts. They notify homeowners and emergency services of potential fires. Water leak sensors detect plumbing issues early. This prevents extensive water damage. Smart security cameras and door locks enhance home security. They deter burglaries and provide evidence if one occurs. These devices do more than just report problems. They actively contribute to preventing significant property damage. This proactive monitoring reduces the likelihood of costly claims.

For policyholders, this means increased peace of mind. They have real-time awareness of their home’s status. They can receive alerts on their smartphones. This allows for quick action. For insurers, the benefits are substantial. Reduced claim payouts are a key advantage. Better risk assessment becomes possible. Insurers can offer discounts for homes equipped with these technologies. This incentivizes adoption. It creates a win-win situation. Homeowners are safer. Insurers manage risk more effectively. Smart home insurance is becoming increasingly popular. It merges technology with protection.

Telematics in Auto Insurance: Driving Safer Roads

Telematics devices are transforming auto insurance. These small gadgets, often connected to a vehicle’s diagnostic port or embedded by the manufacturer, collect driving data. Key metrics include speed, braking patterns, acceleration, and mileage. They also record time of day driving. This detailed information paints a clear picture of a driver’s habits. It helps personalize insurance premiums. Usage-based insurance (UBI) models are a direct result of telematics. These models reward safe driving behavior. They encourage policyholders to adopt safer practices on the road.

Drivers who demonstrate responsible habits can receive lower premiums. This provides a tangible incentive for safe driving. Insurers benefit from reduced accident frequency and severity. This leads to fewer claims and lower costs. Telematics also offers immediate crash detection. This can automatically alert emergency services. It improves response times in critical situations. The integration of telematics not only personalizes policies but also contributes to overall road safety. It fosters a culture of mindful driving. This technology is making auto insurance fairer and more responsive. It rewards individual responsibility.

Wearable Technology and Health Insurance: Promoting Well-being

Wearable technology is extending proactive insurance into health. Devices such as fitness trackers and smartwatches collect vital health data. This includes heart rate, activity levels, sleep patterns, and calorie expenditure. This data offers insights into a policyholder’s lifestyle. Health insurers are leveraging this information. They design wellness programs and offer incentives. These programs encourage healthier living. Policyholders might receive discounts or rewards. This happens for meeting activity goals or demonstrating improved health metrics. The focus is on proactive health management. It aims to prevent costly chronic diseases.

This approach empowers individuals to take control of their health. It provides tools and motivation for positive lifestyle changes. For insurers, it means a healthier policyholder base. This can lead to reduced medical claims over time. However, data privacy is a significant consideration here. Strict protocols must protect sensitive health information. Transparency about data usage is paramount. Despite these challenges, wearable technology is paving the way. It offers a more holistic and preventative approach to health insurance. It promotes well-being through engagement and rewards.

Data, Analytics, and Personalized Insurance Policies

The true power of IoT in insurance lies in the data it generates. Billions of data points flow from connected devices every second. This raw information needs sophisticated processing. Big data analytics and artificial intelligence (AI) play crucial roles. They transform raw data into actionable insights. AI algorithms can identify patterns and predict risks with high accuracy. This allows insurers to move beyond generic risk assessments. They can create highly personalized insurance policies. These policies are tailored to individual needs and behaviors. This is a significant evolution from traditional models.

Personalized policies mean fairer premiums. They accurately reflect an individual’s actual risk. For example, a low-mileage, careful driver pays less. A homeowner with robust smart security receives better rates. Dynamic pricing becomes possible. Premiums can adjust in real-time. This happens as behaviors or environmental factors change. This level of customization enhances the customer experience. Policyholders feel more valued. They understand how their actions influence their coverage. It fosters greater engagement and trust. This data-driven approach is truly revolutionizing how insurance is bought and sold.

Furthermore, predictive analytics can forecast potential events. For example, weather data combined with smart home alerts. This can warn about impending flood risks. This enables proactive measures. Policyholders can secure their homes before a storm hits. This reduces damage and subsequent claims. AI-driven models also streamline claims processing. They can detect fraud more efficiently. They also automate minor claim approvals. This speeds up payouts and improves satisfaction. The synergy of IoT data, big data, and AI is creating a smarter, more responsive insurance ecosystem. It is shifting the entire industry’s operational focus.

Challenges and Future Outlook of IoT in Insurance

While the benefits of IoT in insurance are clear, challenges remain. Data privacy and security are paramount concerns. Policyholders must trust insurers with their personal information. Robust cybersecurity measures are essential. Strict ethical guidelines are also needed for data collection and usage. Consumer adoption is another hurdle. Not everyone is ready to embrace connected devices. Some worry about constant monitoring. Insurers must clearly communicate the value proposition. They must also address privacy fears. Building this trust is critical for widespread integration.

Regulatory frameworks also need to adapt. Current insurance laws were designed for the traditional model. They may not fully account for IoT data and dynamic pricing. Legislators must create new guidelines. These must protect consumers while fostering innovation. Insurers face integration complexities too. Incorporating new technologies requires significant investment. It also demands changes to legacy systems. Training staff and developing new skill sets are necessary. Despite these obstacles, the trajectory is clear. The future of insurance is deeply intertwined with IoT and proactive tech.

The future outlook is promising and dynamic. We can expect even more sophisticated predictive analytics. AI-driven risk models will become standard. Fully automated claims processing for simple incidents will expand. The integration of various IoT ecosystems will grow. This includes smart cities and interconnected health systems. This will create a truly holistic risk management approach. Insurance will become less about repair and more about prevention. It will evolve into a continuous, personalized service. This service protects assets and promotes well-being actively. Understanding these shifts is vital for all stakeholders in the financial market.

Conclusion

The insurance industry is undergoing a monumental transformation. It is moving from a reactive claim-based model to a proactive, prevention-focused approach. The Internet of Things (IoT) and other advanced technologies are the driving forces behind this change. Connected devices in homes, cars, and even on our bodies are generating invaluable data. This data enables insurers to assess risks with unprecedented accuracy. It allows them to offer highly personalized policies. The shift benefits policyholders through enhanced safety, lower premiums, and tailored coverage. Insurers gain by reducing claim frequency and improving operational efficiency.

While challenges such as data privacy and regulatory adaptation exist, the future is clear. Technology will continue to redefine how we perceive and utilize insurance. This evolution demands ongoing engagement from consumers and industry players alike. Understanding these technological advancements is essential. It allows individuals to make informed decisions about their financial protection. It also helps them embrace the opportunities of a more connected world. The journey from claim to prevention is not just a trend; it is the new standard for a smarter, safer, and more responsive insurance experience.