5 Common Financial Mistakes to Avoid in Your 20s and 30s

Introduction

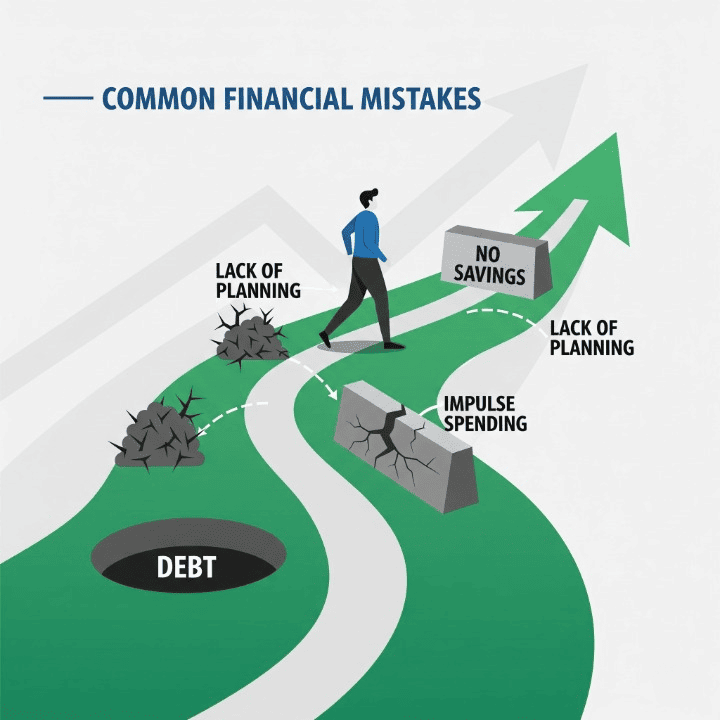

Your 20s and 30s are a pivotal period for personal finance. The habits you build and the decisions you make during this time will lay the foundation for the rest of your life. It is an era of immense change and opportunity—career growth, new relationships, starting a family, and, for many, tackling student loan debt. With so many competing priorities, it is easy to fall into common financial traps that can hold you back for decades. Avoiding these pitfalls is not about deprivation or living a restrictive life. Instead, it is about making smart, strategic choices that will give you a lifetime of financial freedom and security. This guide will explore five of the most common financial mistakes that young adults make and provide clear, actionable advice on how to avoid them, helping you build a life of financial prosperity from the ground up.

Mistake #1: Not Saving for Retirement Early

The biggest financial mistake you can make in your 20s and 30s is to delay saving for retirement. It may seem like a distant goal, but the power of compound interest makes starting early the single most important decision you can make. The more time your money has to grow, the more it will multiply.

Let’s look at a simple example with two individuals. Alex starts saving $200 a month at age 25. He is consistent for 10 years, then stops contributing entirely. His total contribution is only $24,000. Maria starts saving $200 a month at age 35. She is consistent for 30 years until she reaches age 65. Her total contribution is $72,000. Assuming a modest 7% average annual return, Alex will have significantly more money saved at retirement than Maria, even though he contributed a fraction of the amount. This is because his money had an extra 10 years to compound, with his early contributions doing most of the heavy lifting. The takeaway is clear: the most important factor in building retirement wealth is not how much you save, but when you start.

Mistake #2: Accumulating High-Interest Debt

Not all debt is created equal. Debt for a home or an education can be a useful tool for building wealth. However, accumulating high-interest debt, particularly from credit cards, is a major financial mistake that can become a massive obstacle to your financial goals. Credit card interest rates can be as high as 20% or more. This means that a small balance can quickly snowball into a mountain of debt, making it impossible to get ahead.

High-interest debt drains your income and your morale. The money you pay in interest is money you could be using to build your savings, invest for the future, or enjoy your life. A key part of your financial plan should be to prioritize paying off this debt as quickly as possible. Strategies like the debt snowball method (paying off the smallest balance first to build momentum) or the debt avalanche method (paying off the debt with the highest interest rate first to save money) can help you systematically eliminate this financial anchor and free up more of your income for savings and investments.

Mistake #3: Living Beyond Your Means

Many people fall into a trap known as lifestyle creep. As your income increases, your spending increases to match it, or even to exceed it. You get a raise and immediately upgrade your car, move to a more expensive apartment, or start spending more on dining out and entertainment. This prevents you from building wealth. You are making more money, but you are not getting ahead. In a time of economic uncertainty, like the one we face today, living beyond your means can be a recipe for disaster. If a sudden job loss occurs, you have no financial cushion to fall back on.

The solution is simple. Every time you get a raise or a bonus, set aside a portion of that new money for savings and investments. Make a commitment to not let your lifestyle expenses grow at the same rate as your income. This disciplined approach ensures that your income growth contributes directly to your long-term financial freedom.

Mistake #4: Ignoring an Emergency Fund

One of the most foundational principles of personal finance is the need for an emergency fund. An emergency fund is a pool of cash you keep in a safe, easily accessible savings account to cover unexpected expenses. This includes a job loss, a medical emergency, or a major home or car repair. A lack of an emergency fund is a huge financial mistake that leaves you vulnerable to a crisis. Without one, an unexpected event can force you to use credit cards or sell your long-term investments at a loss.

A good emergency fund should cover at least three to six months of your essential living expenses. In a period of high economic uncertainty, such as the one we are in today, aiming for six months or more is a much safer strategy. Having this cash buffer provides invaluable peace of mind. It allows you to weather a storm without financial stress.

Mistake #5: Failing to Invest in Yourself

When we talk about financial mistakes, we usually focus on money. However, one of the biggest mistakes you can make in your 20s and 30s is to stop investing in yourself. Your biggest asset is your human capital—your skills, your knowledge, and your ability to earn an income. The more you invest in these things, the more valuable you become in the job market, and the higher your earning potential will be.

Failing to invest in yourself means staying stagnant. It means not learning new skills, not getting certifications, and not taking courses that could advance your career. By contrast, a commitment to lifelong learning is one of the smartest investments you can make. The money you spend on a course or a new certification could increase your income by an amount that would be very difficult to achieve through the stock market alone. This is an investment that provides a guaranteed return.

Conclusion

The financial decisions you make in your 20s and 30s will have a ripple effect that lasts for decades. By avoiding these five common financial mistakes—failing to save for retirement early, accumulating high-interest debt, living beyond your means, ignoring an emergency fund, and failing to invest in yourself—you can build a foundation for a life of financial security. Taking a proactive and disciplined approach to your finances in this period will empower you to take control of your financial destiny. Your future self will be grateful for the foresight and discipline you show today.