Term vs. Whole Life Insurance: Which One Is Right for You?

Introduction

Choosing the right life insurance policy is a crucial step in any comprehensive financial plan. It’s about more than just a monthly premium; it’s about providing a financial safety net for the people you love most. However, the decision between term and whole life insurance often leaves people feeling overwhelmed. Both policies offer a death benefit, but they are fundamentally different in their structure, purpose, and cost. One is a straightforward financial shield, while the other is a complex tool that combines protection with a savings component. Understanding the core differences is the key to making an informed choice that aligns with your financial goals and the needs of your family. This guide will break down the features, benefits, and drawbacks of both term and whole life insurance, helping you decide which policy is the best fit for your unique situation.

The Core Difference: Pure Protection vs. Protection with Savings

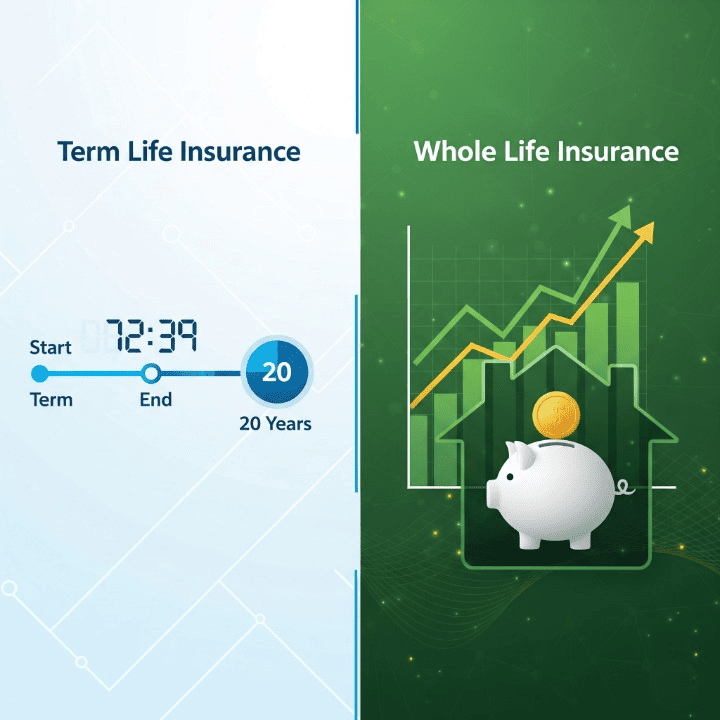

At a high level, the distinction between term and whole life insurance is simple: term life is pure protection, while whole life is a combination of protection and forced savings.

- Term Life Insurance: Think of this as renting insurance. You pay a premium for a specific period, or “term,” which can be 10, 20, or 30 years. If you die during that term, your beneficiaries receive a tax-free death benefit. If you outlive the term, the policy expires, and there is no payout. It is a simple, cost-effective way to cover temporary financial responsibilities, such as a mortgage or the years a child is financially dependent.

- Whole Life Insurance: This is more like owning insurance. It provides a death benefit for your “whole life”—as long as you continue to pay the premiums. In addition to the death benefit, a whole life policy includes a cash value component. A portion of your premium goes into a savings account that grows tax-deferred over time. You can borrow against this cash value or use it to pay premiums later in life.

The primary appeal of term life is its affordability, while the main attraction of whole life is its lifelong coverage and cash value component.

Term Life Insurance: The Flexible and Affordable Choice

Term life insurance is an excellent option for people who need a high amount of coverage for a set period. Its straightforward nature makes it easy to understand and budget for.

Key Features and Benefits:

- Affordability: Premiums for term life are significantly lower than for whole life, especially for younger, healthy individuals. This allows you to get a much larger death benefit for the same cost, providing greater protection during your peak earning and family-building years.

- Simplicity: The policy is easy to understand. It has one job: to pay a death benefit if you die within the term. There are no complex investment features or cash value components to manage.

- Flexibility: You can choose a term that matches your financial needs. For example, a 30-year policy could cover your mortgage and children’s college education, giving you peace of mind until those major expenses are taken care of. Once those responsibilities end, you may no longer need the coverage.

Drawbacks:

- Temporary Coverage: The main disadvantage is that the policy expires. If you outlive the term, you lose the coverage and the money you paid in premiums. If you still need coverage after the term ends, new premiums will be based on your older age and health, which can be prohibitively expensive.

- No Cash Value: There is no savings or investment component. It’s a pure expense, much like car or home insurance.

Term life is often the best choice for individuals and families who need to maximize their death benefit coverage on a limited budget. It’s a foundational piece of insurance that protects against significant financial obligations during a specific stage of life.

Whole Life Insurance: The Permanent and Complex Option

Whole life insurance is a more robust, long-term financial product. It’s designed to provide lifelong coverage and can serve as a forced savings vehicle.

Key Features and Benefits:

- Lifelong Coverage: The policy remains in force as long as premiums are paid, guaranteeing a death benefit for your beneficiaries no matter when you pass away. This is particularly useful for people who want to cover end-of-life expenses or leave an inheritance.

- Cash Value Component: A portion of each premium contributes to a cash value account. This cash value grows tax-deferred over time and is guaranteed to a certain rate. You can access this money through withdrawals or by taking out a loan against it. This feature makes it a useful tool for financial planning, as it can be used for things like supplementing retirement income or funding a child’s education.

- Predictable Premiums: Premiums for a whole life policy are level and never increase. This predictability can be a significant advantage for long-term budgeting.

Drawbacks:

- High Cost: Premiums are significantly higher than for term life insurance, often five to ten times more expensive for the same amount of coverage. This higher cost can make it difficult to afford enough coverage to meet your immediate needs.

- Lower Rate of Return: The guaranteed rate of return on the cash value is typically low, often less than what you could earn by investing the same money in a diversified portfolio of stocks or bonds. You are essentially paying for a product that bundles an investment and protection, which may not be the most efficient use of your funds.

- Complexity: Whole life policies can be complex to understand, with multiple fees and moving parts.

Whole life is a suitable option for individuals with high-income who have already maxed out their other retirement savings vehicles, such as a 401(k) and IRA, and are seeking an additional tax-advantaged savings tool. It can also be a valuable tool for estate planning.

A Practical Example: The Case of John and Jane

To put it all into perspective, let’s consider a hypothetical couple, John and Jane, both 35 with a young child and a new $400,000 mortgage. Their goal is to ensure the mortgage is paid off and their child’s college education is funded if one of them were to pass away.

- Term Life Option: John and Jane could each buy a 20-year term life policy for $500,000. This amount would cover the mortgage and college costs. The premiums would be relatively low, perhaps $40-50 per month each. The low cost allows them to save and invest the money they would have spent on a more expensive whole life policy. Over 20 years, they would have a significant amount of money invested in a separate, diversified portfolio, which will likely grow at a higher rate than the cash value in a whole life policy.

- Whole Life Option: Alternatively, they could each purchase a whole life policy. For the same $500,000 in coverage, the premiums could be $400-500 or more per month. This higher cost would put a strain on their budget, potentially limiting their ability to save for retirement or other goals. While the policy would provide lifelong coverage and a cash value, the immediate financial burden is much higher, and the rate of return on the cash value might be underwhelming compared to a traditional investment account.

In this scenario, a term life policy is the more logical and financially sound choice for meeting a temporary need and allowing them to build wealth through separate, more efficient investment vehicles.

The “Buy Term and Invest the Difference” Strategy

A popular strategy among financial advisors is “buy term and invest the difference.” The idea is to buy an affordable term life policy for the coverage you need and then invest the money you save by not buying a more expensive whole life policy. This allows you to:

- Maximize Protection: You get a high death benefit for the lowest possible cost, protecting your loved ones during your most financially vulnerable years.

- Control Your Investments: You have complete control over your investments and can choose a portfolio that aligns with your risk tolerance and goals.

- Potentially Higher Returns: Historically, a diversified investment portfolio has delivered higher returns over the long term than the cash value component of a whole life policy.

This strategy separates insurance from investing, treating each as a distinct financial tool. It allows you to get the best of both worlds: robust protection for your loved ones and the potential for greater wealth accumulation through your own investment efforts.

Conclusion

The choice between term and whole life insurance is a personal one that depends on your specific financial situation and goals. Term life is the ideal choice for most people, offering high-level, affordable protection for a defined period of time. Its simplicity and cost-effectiveness make it a powerful tool for safeguarding your family against a temporary but significant financial risk. Whole life, with its lifelong coverage and cash value, is a more complex and expensive product that may be beneficial for individuals with specific estate planning needs or who have already maximized their other investment opportunities. By understanding the fundamental differences between these two types of policies, you can make a decision that protects your loved ones and aligns with your long-term financial vision.